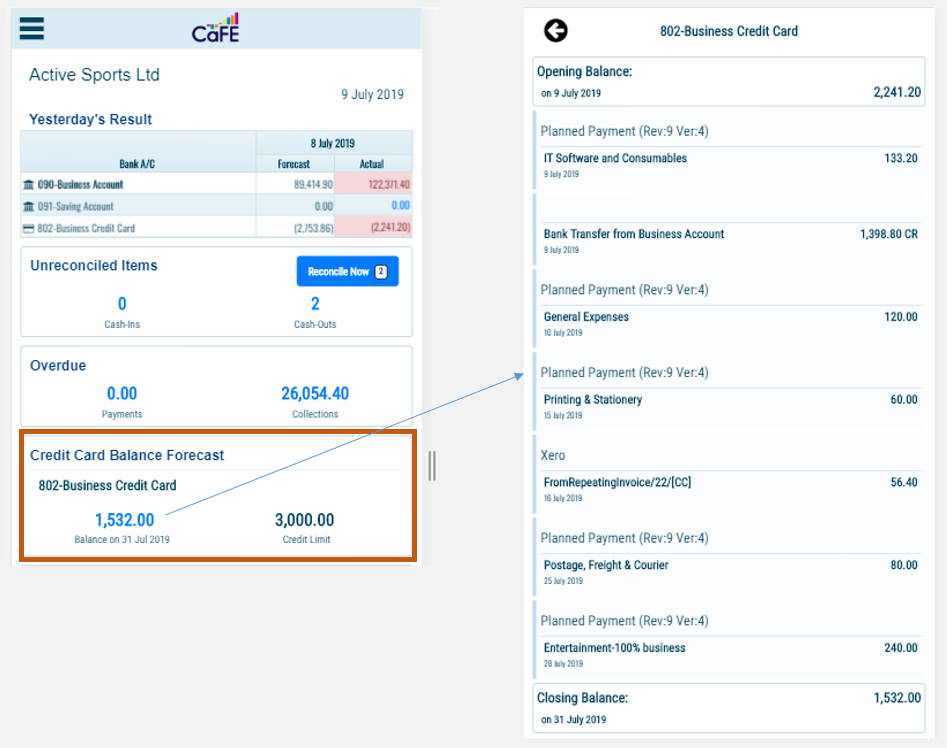

What our financial experts can do for you: We can help you determine your financial requirements for your startup and develop a more efficient planning and cash flow forecasting for budgeting, including operational and staffing plans.Ĭreditors and investors will also want to see the prospective financial data that reflects expectations of revenue and profit. Unfortunately, few investors will make a financial commitment if forecasts are unavailable. Many entrepreneurs complain that building accurate revenue and expenses forecasts requires too much time that would be better spent selling rather than planning. Typically, the historical financial data to include are your company's income statements, balance sheets, and cash flow statements for each year you have been in business (usually for up to three to five years). If you own an established business, we help you to meet creditor requests for historical data related to your company's performance for the last three to five years, depending on the length of time you have been in business. Here is a list of important financial statements we include with financial projections: CFO Selections’ team develops financial projections, determines effective resource allocations and sets clear objectives. Financial Projections Accounting ServicesĪll businesses, whether startup or growing, will be required to supply prospective financial data for creditors or investors. Projections are made by the month for the first year and then by the year for the next two years.ĭeveloping financial projections for your expanding business can be complicated. To make it less overwhelming, our expert finance team can provide the information on required financial statements every business plan should have. Depending on how long you’ve been in business, it could be more… or less.įinancial projections should include a forecasting of the income statement, the balance sheet, and the cash flow statement.

Creditors typically want these types of information for the past and future three to five years.

If your business has been in operation for more than a year, creditors will not only request data on your past performances, referred to as historical data, they will also ask for financial projections. The projected financial plan indicates how much additional debt or equity you need to remain solvent and healthy. Financial projections help you assess what additional assets are needed to support increased revenue and the potential impact on your balance sheet. To generate and support additional revenues, additional cash is always required. Projections can also be a guide to help your business grow without running out of cash. The financials tell you what goals to keep and what to cut. Creating financial projections is not an easy task but is a very important part of developing a sound strategy. By projecting your revenue and expenses, you can get a more accurate view for how successful your business can be. An important part of the business planning process is the preparation of financial statements to predict the outcome of an organization’s results in future periods.įinancial projections are based on compiling the internal and external accounting data you already use in the day-to-day management of your business.

0 kommentar(er)

0 kommentar(er)